universal life insurance face amount

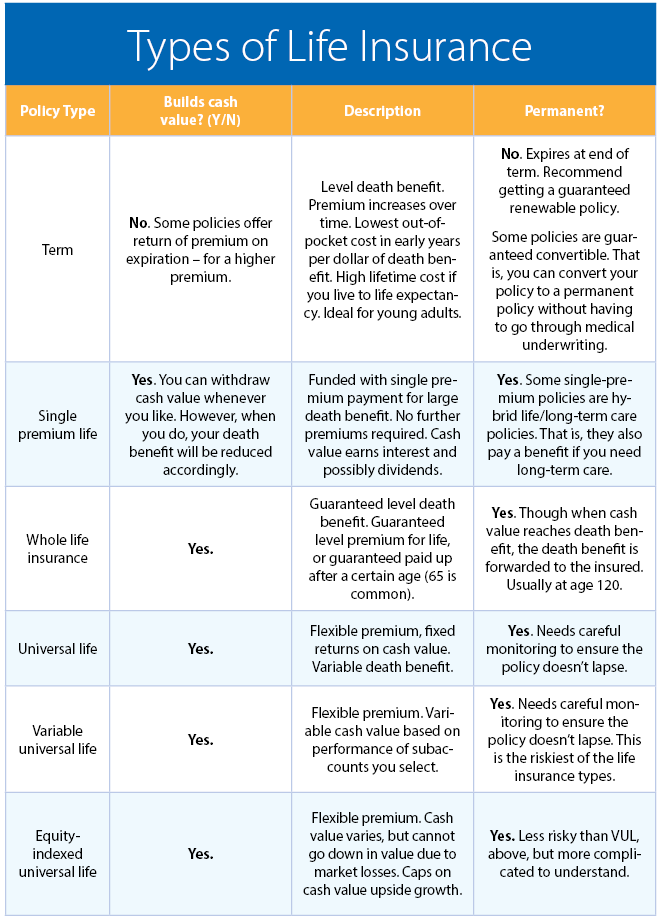

Variable lifes premiums are mostly invested in investment accounts such as stocks mutual funds bonds and money markets. The policyholders flexibility extends to the amount of the monthly premiums paid as well as their frequency.

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

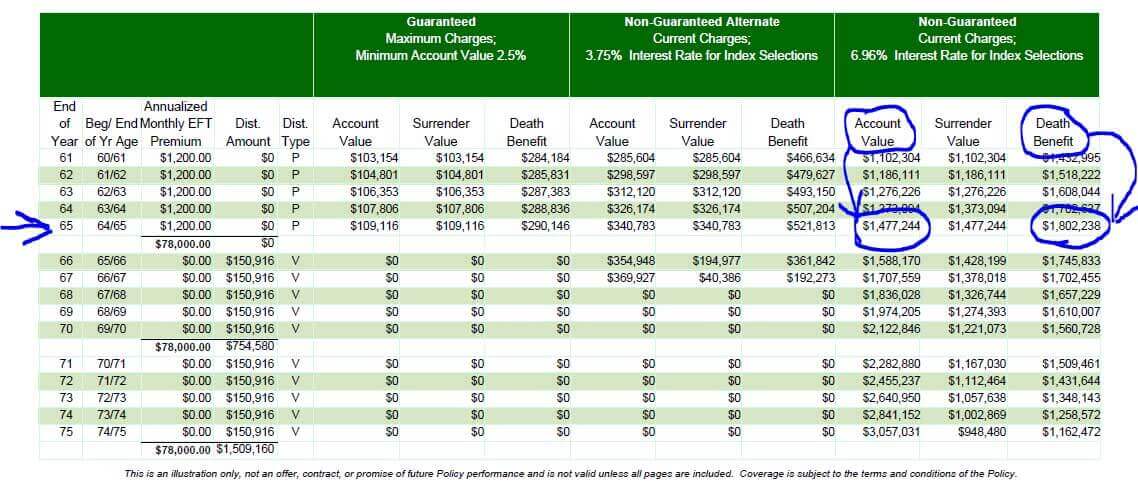

An example to help illustrate just how this happens.

. She decides to make an annual payment of 1300 and let the difference between the 1300 she is paying and the 700 that goes to the insurer accumulate in her account. Car Insurance Menu Toggle. Universal life insurance is a type of permanent life insurance.

The amount is known as face value if it is mentioned and identified in the dollar amount. Theyre both permanent life insurance they both have cash value and they let you change your payments and death benefit amount. When a life insurance policy is identified by a dollar amount this amount is the face value.

Anne takes out a 200000 universal life insurance policy. A 500000 policy therefore has a face value of 500000. Universal life insurance often shortened to UL is a type of cash value life insurance sold primarily in the United StatesUnder the terms of the policy the excess of premium payments above the current cost of insurance is credited to the cash value of the policy which is credited each month with interestThe policy is debited each month by a cost of insurance COI charge.

As long as the policy owner funds the account and a certain amount of money is within the account then the policy will never fall victim to a grace period or lapse. Universal life insurance is a type of permanent life insurance that offers an investment savings element in addition to low premiums. Worry less about the future with term life insurance.

The coverage amounts range from as little as 25000 to more than 1. Heres how it breaks down. When choosing your universal life insurance amount youre choosing the death benefit or the money youll leave behind for your beneficiaries.

The policy costs 700 a year. Guaranteed universal life insurance. Variable universal life VUL is a type of permanent life insurance policy with a built-in savings component that allows for the investment of.

Variable life policies are riskier than variable universal life. The 20000 that remains will be collected by the insurance company. The Moment of Truth.

How Much Car Insurance Do I Need. The acquisition of face value depends on certain factors. For example a 500000 insurance policy will have a face value of a similar range.

Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. The Advantage of Cash Value. Guaranteed universal life insurance is a universal life insurance policy that wont lapse if the cash value is zero.

Generally the availability of funds cost-effectiveness and coverage will be determined by the insurance company. However Anne can opt to pay up to 1500 a year. For instance if the face value of your whole life policy is 200000 and the cash value that has accumulated is valued at 20000 when you pass away the beneficiaries of your policy will receive the 200000 face value of your policy.

The Most Efficient Ways to Buy Car Insurance. It allows for a greater degree of flexibility and often lower cost than whole life insurance another popular type of permanent insurance. Average Costs Premiums.

Universal life insurance contracts have a cash value account that the policy owner can fund as much as they like which then enables any cost of insurance charges to be removed from this account. What Does Car Insurance Cover. Given this it can essentially behave as a term life insurance policy with the term ending at whatever age the policy matures whether thats when you turn 90 100 or 121.

Loading Skip to content. Universal life insurance face amount. The actual death benefit paid on a death claim could differ from the face amount due to death benefit options policy riders loans interest on loans and withdrawals.

If the cash value on a policy is 10000 and you die the insurance company pays 50000 but the insurance company keeps the. Face Amount is the amount of life insurance that a policy owner purchases.

Life Insurance Loans A Risky Way To Bank On Yourself

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Are Paid Up Additions Pua In Life Insurance

Understanding Universal Life Insurance Forbes Advisor

What Are Paid Up Additions Pua In Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Independent Agent S Guide To Indexed Universal Life Insurace 2022

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Cash Value And Cash Surrender Value Explained Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Difference Between Cash Value And Face Value In Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Cash Value And Cash Surrender Value Explained Life Insurance

Universal Life Insurance Everything You Need To Know 2022

Life Insurance Policy Loans Tax Rules And Risks

Understanding Life Insurance What Policy Type Is Best For You

Term Life Vs Universal Life Insurance

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth